If you buy a share of stock on the 2nd you won’t own it until the 4th.Īs a result of this lag time, it is entirely possible for someone to both have purchased shares of a stock by the dividend record date and yet not be the stock’s registered owner at the deadline.

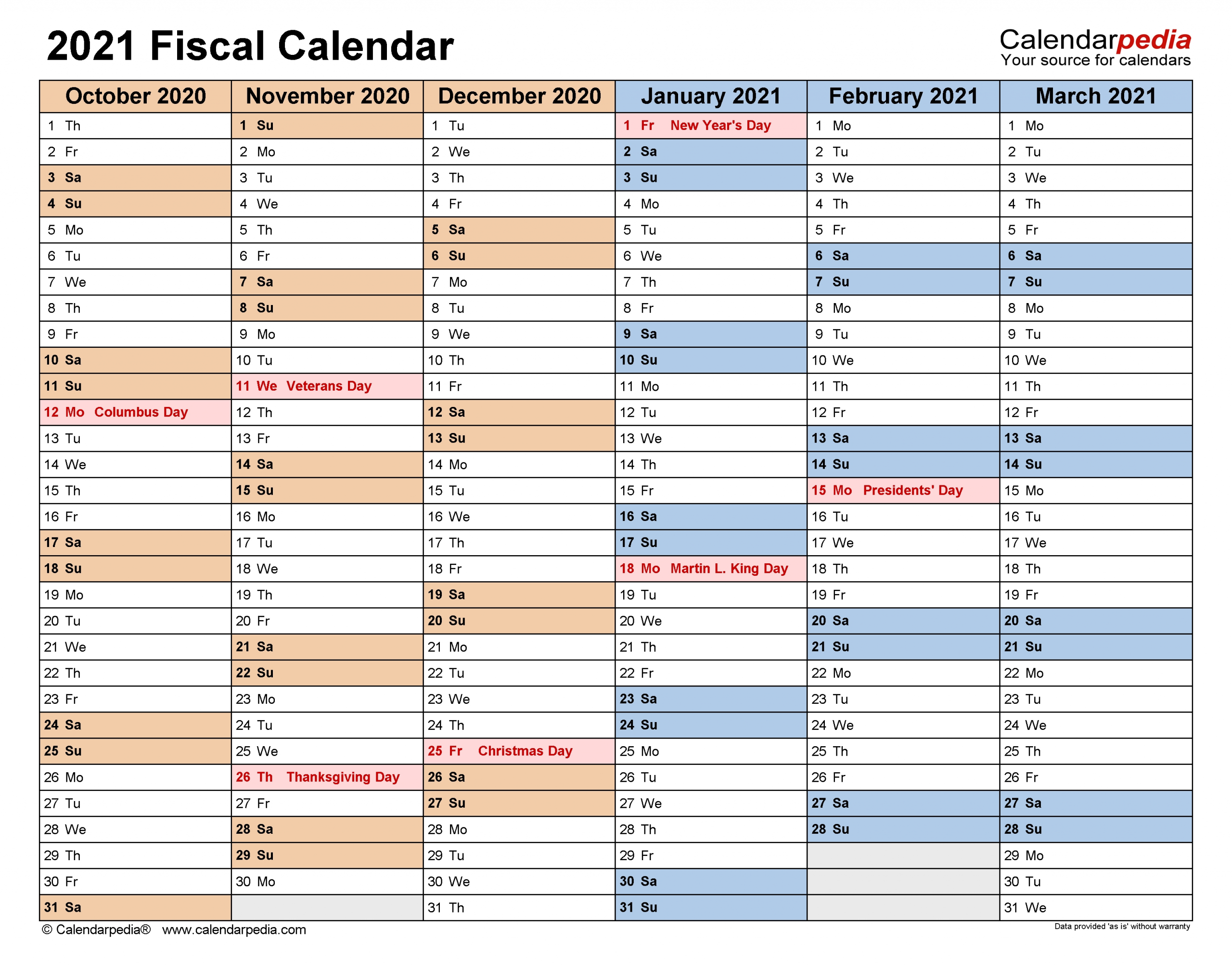

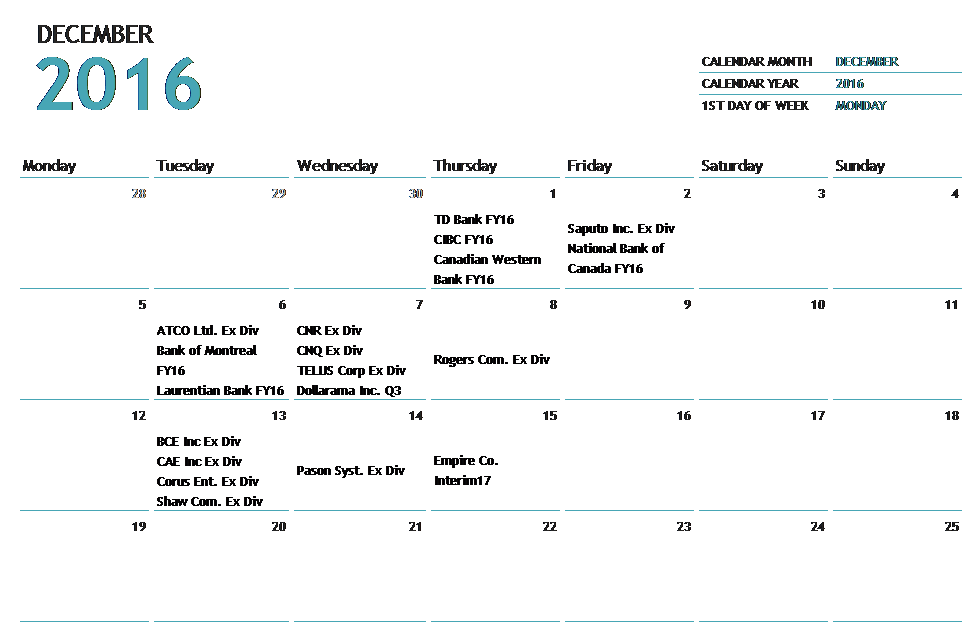

If you make a purchase on the 1st of the month, ownership will transfer on the 3rd, assuming there’s no weekend or holidays between the two dates, and vice versa. markets (as well as other major markets). The relationship between the ex-dividend date and the dividend record date reflects the fact that it takes two business days to complete a stock transaction in U.S. This makes the accounting process much easier. By separating the dividend record date from the payment date the firm gets time to clearly establish every entity that is entitled to collect a dividend. If it simply assigned dividend payments based on ownership on the date of payment, the firm would struggle to organize its books. The dividend record date gives a company certainty. This can push the ex-dividend date back significantly depending on weekends or holidays. The ex-dividend date is typically one business day before the dividend record date. Instead, on and after this date, the seller retains that right. The ex-dividend date is the day on which shares of a given company’s stock no longer come with the right to collect the next dividend payment. If anyone buys or sells shares after this date, the company still makes its payment to the entity that was the recorded owner on the dividend record date. This is true even if you buy shares of the stock before the company actually pays its dividends. Anyone who is not a recorded owner of qualifying shares on the dividend record date will not. Anyone who is the recorded owner of qualifying shares on the dividend record date will receive a payment. The dividend record date is the date set by a company to determine eligible shareholders when it announces a dividend. To smooth these transactions, companies apply two concepts: the dividend record date and the ex-dividend date. This can lead to a potentially chaotic system, as companies might not always know who they owe dividend payments to at any given time. On the other hand, there is a gap between when companies announce that they’re paying dividends and when those payments actually arrive. They trade constantly and in high volumes. On the one hand, stocks are extremely fluid assets.

The dividend record date solves the problem of the rapid change in a publicly traded corporation’s ownership.

0 kommentar(er)

0 kommentar(er)